Contents

- 1 At a Glance: Healthcare software development in the Middle East

- 2 Introduction: Why Healthcare Software Development Is Accelerating in the GCC

- 3 Types of Healthcare Software Development

- 4 Key Challenges in Healthcare Software Development

- 5 Interoperability & Integration: Connecting Healthcare Ecosystems

- 6 Cost of Software Development in the Healthcare Industry

- 7 ROI Analysis: Healthcare Software Investment Returns in the Middle East

- 8 Success Stories: Healthcare Software Transformations in UAE & Saudi Arabia

- 9 Conclusion

- 10 FAQs

At a Glance: Healthcare software development in the Middle East

- GCC regions like, UAE, Saudi Arabia, Qatar, Oman, and Kuwait are undergoing major health sector reform, with digital health being central to national strategies

- Demand is highest for EHR/EMR systems, telemedicine platforms, appointment scheduling apps, insurance claims tools, and AI-powered diagnostics.

- Healthcare spending in the Gulf is projected to reach $135.5 billion, powered by AI, robotics, and digital platforms. The digital health market is expected to reach over $45 billion by 2035

- GCC governments are mandating data privacy (UAE PDPL, Saudi NCA) along with healthcare IT standards (HL7, FHIR, ISO 27001) as core requirements for market entry.

Introduction: Why Healthcare Software Development Is Accelerating in the GCC

The healthcare software development market in the Middle East region is driven by increasing demand for telemedicine, health monitoring apps, consultation apps, wearable technology, etc.

From national health portals to smart clinics and virtual care platforms, software is now at the core of how medical services are delivered, managed, and improved.

This growth is backed by strong funding trends in the GCC. Companies like Altibbi (raised $44 million in 2023) and klaim- providing AI based claims management software for health care professionals, founded in 2020, are a series a funded company with $17.6M.

Governments are launching major initiatives—Saudi Arabia’s Digital Health Strategy and the UAE’s Riayati(Pandemic Digital Health Blueprint). These software platforms require secure, compliant, bilingual software platforms tailored to local health systems.

In this guide, we explore healthcare software development in the Middle East, essential principles for building healthcare software, planning for regional UX, data privacy, and system interoperability.

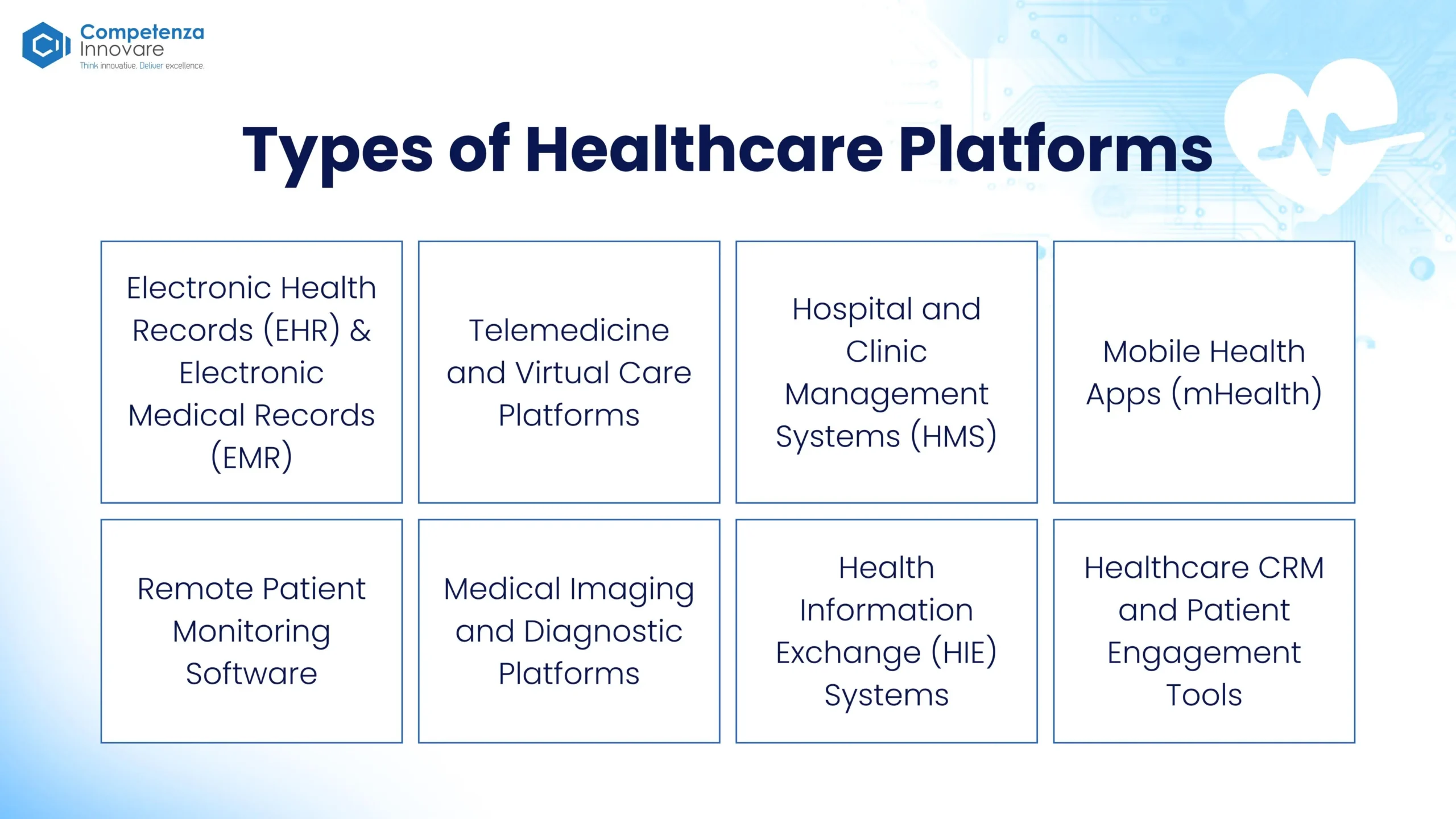

Types of Healthcare Software Development

These medical software solutions are primarily built for two core user groups: healthcare professionals such as doctors, clinicians, and administrative staff and patients who demand personalized, seamless, and tech-enabled care experiences.

Improved access through telemedicine to streamlining operations with hospital management systems, the right software can enhance both clinical outcomes and operational efficiency.

Below are the key categories of healthcare software currently gaining traction across GCC nations.

1. Electronic Health Records (EHR) & Electronic Medical Records (EMR)

EHR and EMR softwares are foundational to digital healthcare infrastructure to digitize patient records, streamline provider collaboration, and ensure compliance with local data protection laws like Saudi Arabia’s NCA regulations and the UAE’s PDPL.

Cross-border EHR systems are now standard in the Middle East public and private hospitals. Over 75% of public healthcare facilities in GCC countries have implemented EHRs.

Saudi Arabia based Athir provides unified EMR and claims-management platforms across clinics and hospitals.

2. Telemedicine and Virtual Care Platforms

Driven by rising patient demand and national eHealth mandates, telemedicine software enables remote consultations, AI-enabled triage, digital prescriptions, and chronic disease monitoring.

Dubai health authority offers Doctor for Every Citizen’ service through the DHA app. Alma health, focused on chronic disease management, provides patients with teleconsultations and home medication delivery, specifically targeting chronic conditions such as diabetes and hypertension.

3. Hospital and Clinic Management Systems (HMS)

These platforms support operations such as appointment scheduling, billing, inventory management, insurance claims, and staff coordination, key for streamlining care delivery and administration in growing private healthcare markets.

Clinicy, a Saudi Arabia based startup offers cloud-based software for clinic management and patient engagement.

4. Mobile Health Apps (mHealth)

From fitness tracking to condition-specific support (like diabetes or hypertension), mHealth apps in the GCC are gaining traction among younger populations. Localized UX, bilingual interfaces, and cloud-based analytics are must-haves.

5. Remote Patient Monitoring Software

With growing interest in preventative care, especially in Saudi Arabia and Qatar, RPM software helps track vitals, medication adherence, and wellness metrics. Through wearables and IoT integration they real-time data to physicians for proactive intervention.

Hoope View partnership with clinitouch is strengthening remote monitoring technology in the KSA.

6. Medical Imaging and Diagnostic Platforms

AI-powered diagnostic solutions that support radiology, pathology, and cardiology are being adopted to reduce dependency on specialized talent and enhance diagnostic speed.

7. Health Information Exchange (HIE) Systems

HIE platforms facilitate secure data sharing between hospitals, labs, and insurance providers. In the GCC, they are critical for establishing unified national health records and supporting medical tourism initiatives.

8. Healthcare CRM and Patient Engagement Tools

Healthcare CRMs are designed to personalize care journeys, automate outreach, collect patient feedback, and enhance appointment follow-ups which drive better engagement, retention, and overall patient satisfaction.

Key Challenges in Healthcare Software Development

While the private and government-led organizations in the Middle East region are aggressively investing in digital health, healthcare software development presents its own set of technical, regulatory, and operational complexities. Addressing these challenges early is critical to successful software implementation and adoption.

1. Regulatory Compliance Across Jurisdictions

Middle East regions like Saudi Arabia and the UAE have their own evolving data privacy laws. Compliance with multiple regulations like- PDPL, Saudi NCA, MOHAP, etc. MOHAP has laid out specific deadlines for healthcare software providers to align with national eHealth standards.

Non-compliance can result in blocked product launches, license withdrawal, and fines that may exceed AED 250,000.

MOHAP compliance checkpoints for 2025 include mandatory HL7 support, centralized EHR sync, and region-based data storage.

Systems should be built to support structured medical data, adaptive interfaces, and seamless reporting for government audits.

2. Security and Patient Data Privacy

3. Interoperability With Existing Systems

Hospitals and clinics often use legacy EHRs or siloed departmental tools for patient records and insurance. Integrating new platforms with these systems without disrupting operations demands robust APIs, standard HL7/FHIR compliance, and domain experience.

4. Multilingual and Culturally Sensitive UX Design

Arabic-English bilingual interfaces, RTL layouts, and regional healthcare workflows are essential. Poor localization can lead to lower adoption rates, effective usage, and ineffective patient engagement.

Development teams should co-design healthcare software solutions with clinical users to ensure alignment with daily practices and reduce friction.

5. Scalability and Infrastructure Constraints

Healthcare organizations need solutions that can scale securely as operations grow across cities or regions. Implementing offline-first capabilities, data caching, sync, and regional server hosting should be prioritized to ensure uninterrupted service delivery.

6. Clinical Validation and Stakeholder Buy-in

Without clinical input and testing, healthcare tools may face skepticism from providers. Building software that clinicians trust requires iterative validation, continuous feedback loops, and user-centric design.

Interoperability & Integration: Connecting Healthcare Ecosystems

Interoperability is increasingly vital to healthcare delivery in the Middle East for secure flow of patient information across providers, patients, payers, and public health administrators.

Why Interoperability Matters in the Middle East

Governments in Saudi Arabia, UAE, and Qatar are pushing for connected care ecosystems that align with national digital health strategies.

UAE’s Riayati and Saudi’s Seha systems aim to unify patient records across hospitals, labs, and pharmacies, enabling efficient care delivery and population health analytics.

AI algorithms are now capable of reconciling patient identities across disparate systems, interpreting unstructured clinical data, and enriching EHRs with real-time insights.

AI algorithms are now capable of reconciling patient identities across disparate systems, interpreting unstructured clinical data, and enriching EHRs with real-time insights.

Saudi Arabia’s NEOM is a live testbed for AI-powered healthcare models. The UAE’s AI Strategy 2031 positions intelligent systems at the core of digital health services. These initiatives go beyond policy—they are redefining the architecture of connected care.

Without proper integration, siloed platforms lead to delays, repeated diagnostics, data entry errors, and suboptimal patient experiences.

key Integration Use Cases

- Synchronizing patient data across EHR, pharmacy, billing, and insurance platforms

- Integrating wearable and IoT data into care workflows

- Connecting health apps with national health IDs and e-prescription systems

- Enabling real-time alerts and decision support via clinical APIs

Technical Considerations

- HL7 and FHIR data standards

- secure, standards-based APIs

- middleware for older legacy systems

- OAuth2/OpenID for identity federation

Cost of Software Development in the Healthcare Industry

Healthcare software development costs in the Middle East depend on solution complexity, regulatory demands, and system integrations.

A simple patient-use app or a consultation app is far less costly than an enterprise-grade healthcare platform with AI, compliance, and multi-point interoperability.

Average Cost Ranges in the GCC Region

Basic Solutions (AED 75,000 – 150,000)

Appointment booking apps, symptom checkers, and wellness trackers with minimal backend needs.

Ideal for clinics or startups aiming to offer simple digital touchpoints.

Mid-Range Software Solutions (AED 150,000 – 400,000)

EHR systems, remote patient monitoring, and digital prescription tools with role-based access.

Serve hospitals and specialty care providers with regulatory needs.

Enterprise Platforms (AED 400,000+)

Custom-built HMS, AI-powered diagnostics, or multi-platform telemedicine platforms with cross-border compliances.

Used by healthcare groups, government hospitals, and cross-border medical networks.

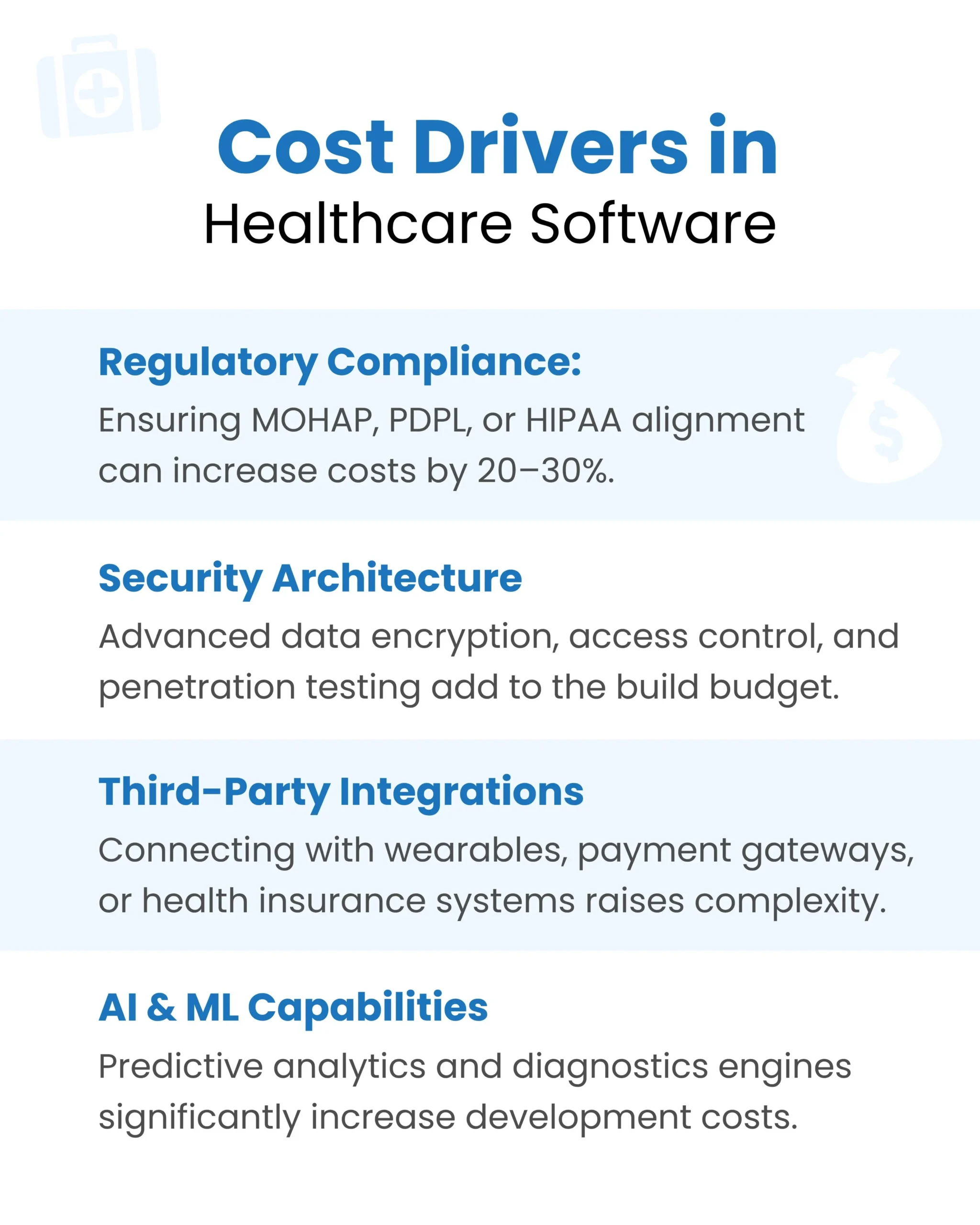

Cost Drivers in Healthcare Software

- Regulatory Compliance: Ensuring MOHAP, PDPL, or HIPAA alignment can increase costs by 20–30%.

- Security Architecture: Advanced data encryption, access control, and penetration testing add to the build budget.

- Third-Party Integrations: Connecting with wearables, payment gateways, or health insurance systems raises complexity.

- AI & ML Capabilities: Predictive analytics and diagnostics engines significantly increase development costs.

ROI Analysis: Healthcare Software Investment Returns in the Middle East

Custom healthcare software solutions are a strategic investment across GCC nations, especially in high-growth markets like Dubai, KSA, Abu Dhabi, and Riyadh.

While initial development costs can range from AED 75,000 to AED 1 million depending on complexity, the returns significantly outweigh the upfront spend considering the impact areas like- operational savings, improved outcomes & accuracy, long-term efficiency, and adaptability.

For instance, Dubai-based hospitals using custom EMR platforms have reported a 35 percent reduction in documentation errors and cut down on patient wait times by up to 40 percent. These gains translate directly into reduced operational overhead and better patient throughput.

Unlike off-the-shelf tools, custom platforms avoid recurring licensing fees, allow unlimited user scaling, and eliminate patchy integrations with third-party hospital management systems.

Moreover, software built to regional compliance like MOHAP (UAE) or SFDA (Saudi Arabia) ensures zero delays in deployment and reduces costly rework or penalties.

Optimizing Costs in Healthcare Software Development

Strategically managing costs without compromising on compliance, usability, or performance is essential for successful healthcare software development in the Middle East. Here are four effective ways to optimize your investment:

1. Start with a Feature-Led MVP Approach

Limit initial development to essential features that directly impact patient experience or operational efficiency like- scheduling, e-prescriptions, or EMR dashboards. This helps validate product-market fit while avoiding upfront overinvestment.

2. Use Cross-Platform Frameworks for Multi-Device Access

Frameworks like Flutter or React Native enable hospitals and clinics to deploy a single codebase across Android, iOS, and web platforms. This reduces development time, maintenance overhead, and accelerates rollout to patients and providers across different devices.

3. Leverage Cloud Infrastructure and Modular APIs

Deploying on regional cloud platforms (like AWS UAE or Oracle Saudi Arabia) eliminates costly on-premise infrastructure. Modular integrations using HL7/FHIR APIs for interoperability or AI engines for predictive care also reduce long-term rebuild costs.

4. Outsource to Regionally Experienced Development Partners

Working with outsourcing teams experienced in MOHAP, SFDA, and GCC-specific compliance requirements ensures that development is compliant from the outset. This reduces the risk of rework, accelerates approvals, and ensures cost-effective scaling aligned with local regulations.

Success Stories: Healthcare Software Transformations in UAE & Saudi Arabia

With increasing demand for real-time access, better patient outcomes, and region-specific compliance, healthcare providers across the UAE and Saudi Arabia are investing in smart software solutions. The following real-world examples reflect measurable gains in efficiency, security, and patient experience.

1. Saudi Telemedicine Startup Launches MOH-Compliant Platform

Based in Saudi Arabia, Athir’s core product is a unified electronic medical records (EMR) and insurance claims management platform.

It enables healthcare providers to streamline operations, reduce administrative errors, and improve patient outcomes through digitized workflows.

As Saudi Arabia accelerates its Vision 2030 goals, Athir stands out as a strategic enabler of health system modernization, delivering tech infrastructure that supports national insurance integration and healthcare digitalization.

Key Results:

- 30% reduction in patient onboarding time

- Integrated insurance workflows with automated claim validation

- Compliance: Saudi NPHIES, PDPL-compliant

2. AI-powered Healthcare Supply Chain Optimization in Saudi Arabia

Aumet, originally founded in Jordan and now expanding into Saudi Arabia, operates an AI-driven B2B marketplace for medical supplies.

By connecting pharmacies, distributors, and manufacturers, the platform reduces inefficiencies and improves inventory management.

Impact:

- Raised $7 million in Pre-Series A funding to expand across the GCC

- Predictive AI tools streamline procurement and reduce supply chain delays

- Enhancing access to under-networked medical logistics across North Africa and the Middle East

3. Oncology Innovation in the UAE

BioSapien, a UAE-based medtech innovator, is revolutionizing cancer treatment with its 3D-printed MediChip implant. This device delivers chemotherapy directly to cancer cells, minimizing side effects and boosting treatment precision.

Impact:

- Secured $7 million in Pre-Series A extension funding (January 2025) led by Global Ventures and Golden Gate Ventures

- Significant advancement in localized chemotherapy and personalized oncology care

- Plans to accelerate clinical trials, regulatory approvals, and international research partnerships

4. AI-Powered Chronic Disease Management in Qatar

Lillia, a Qatar-based healthtech startup, is leveraging digital twin technology to revolutionize chronic disease care. Its AI-driven platform creates virtual replicas of patients to simulate disease progression and personalize treatment based on real-time health data.

Impact:

- Received a $1.7 million grant from the Qatar Research, Development & Innovation Council (QRDI) in March 2025

- Enables predictive and personalized care for chronic illness management

- Supports the Gulf region’s push toward AI-integrated, patient-centric healthcare solutions

5. Alma Health’s Chronic Care Platform in KSA

Alma Health rolled out its chronic disease management platform with a localized version for the Saudi market with a vision to create a world where chronic conditions no longer complicate the lives of those they affect.

It offers virtual consultation, prescription, and free of cost medicine delivery.

Alma health apps are available on Apple store, Play store, and Huawei app gallery.

Success Metrics:

- 80% medication adherence rate among enrolled patients

- 4.7-star user rating across app stores

- Supported by KSA’s unified health record vision

6. Seha Virtual Hospital Connects Remote Patients to Specialists

Saudi Arabia’s flagship Seha Virtual Hospital now supports 44 specialties, offering virtual diagnostics and treatment.

Impact:

- Reduced specialist appointment wait times by 60%

- Enabled 24/7 care access in remote governorates

- National-level data integration with AI triage systems

As the demand for tech-driven, efficient healthcare solutions rises, a new wave of healthtech startups is gaining serious investor confidence. From AI-powered diagnostics to full-service e-pharmacies.

Other success stories include- UDENZ, a dental health platform based in the UAE, Valeo, a UAE-based personalized healthcare platform, Clinicy is a Saudi startup offering cloud-based software for clinic management and patient engagement, etc.

Conclusion

Telemedicine platforms, consultation apps, remote monitoring tools to AI-powered diagnostics and integrated hospital management systems, healthcare softwares are the foundation of modern healthcare delivery.

However, success depends not just on technology, but on building solutions tailored to the healthcare ecosystem in Dubai, Saudi Arabia, and across the GCC.

For organizations seeking to build, modernize, or scale their healthcare platforms, working with a development partner that understands the regional nuances and global best practices is critical.

Looking for expert healthcare software development consultation in Dubai? Connect with Competenza today and build smarter, secure, and scalable healthtech solutions.

FAQs

What types of healthcare software are most in demand in the Middle East region?

The most in-demand healthcare software solutions in the Middle East include electronic health records (EHR/EMR), telemedicine platforms, remote patient monitoring (RPM), hospital management systems (HMS), and mobile health apps. With rising adoption in UAE and Saudi Arabia, demand is also growing for AI-powered diagnostic tools, wearable tech integrations, and compliance-focused patient portals aligned with MOHAP and SFDA regulations.

How do you ensure healthcare software is compliant with Middle East regulations like MOHAP and SFDA?

Compliance starts at the planning stage. We follow regulatory frameworks such as UAE’s MOHAP healthcare software standards, Saudi Arabia’s SFDA guidelines, and regional data protection laws like the UAE PDPL. Our healthcare software development process includes data encryption, audit logging, access control, secure cloud infrastructure, and integration of regulatory reporting tools to meet all local compliance mandates.

What is the typical cost of developing a healthcare software solution in the GCC?

Healthcare software development costs in the Middle East vary by scope, complexity, and compliance needs. Basic telehealth apps may start from AED 150,000, while integrated platforms like hospital management systems can exceed AED 500,000. Costs also factor in regulatory readiness, third-party integrations, multi-language support, and advanced analytics. Outsourcing parts of development to experienced partners can help reduce costs while maintaining compliance.

Why is healthcare software interoperability important, and how do you achieve it?

Interoperability enables seamless exchange of patient data across systems like EMRs, labs, and insurance providers, which is vital for coordinated care and regulatory reporting in the Middle East. We ensure interoperability using HL7/FHIR standards, API-first development, and custom middleware. Integration with UAE-based platforms and legacy hospital systems is a priority for our healthcare software solutions.

Can Competenza help with end-to-end healthcare software development in Dubai and the GCC?

Yes. Competenza offers full-cycle healthcare software development services tailored for Dubai, UAE, and GCC markets. From compliance consulting and UI/UX design to development, QA, deployment, and support—we deliver secure, scalable, and region-specific solutions. Whether you’re building a patient-facing app, hospital backend system, or wearable-connected platform, we align with healthcare innovation strategies across the Middle East.