Contents

- 1 At a glance: How UAE enterprises are applying AI today

- 2 Why is AI a business imperative in the UAE?

- 3 Enterprise AI opportunities in the UAE by sector

- 4 Top challenges in enterprise AI adoption

- 5 AI tools and technologies used in the UAE

- 6 How can enterprises prepare for AI adoption and implementation?

- 7 How Competenza enables AI success for UAE enterprises

- 8 Conclusion: Building enterprise value with AI in the UAE

- 9 FAQs

At a glance: How UAE enterprises are applying AI today

- AI adoption is being driven by national strategy, with the UAE targeting a 14% GDP contribution from AI by 2030

- key sectors applying AI include finance, logistics, manufacturing, and healthcare

- Enterprise goals include reducing manual processes, accelerating decision-making, and enhancing service quality

- Major challenges include data privacy compliance, legacy system constraints, and shortage of AI talent

- Most companies are starting with AI pilots or focused MVPs before scaling across business units

Why is AI a business imperative in the UAE?

“AI is a great equalizer for the Middle East region when it comes to advancing technology adoption and innovation.”

— Yousef Barkawie, AI and data leader, Deloitte Middle East

AI is a present-day priority backed by government policy, economic strategy, and global industry competition.

The UAE Strategy for Artificial Intelligence 2031 aims to position the country as an AI leader, driving adoption across both public and private sectors.

With AI projected to contribute up to 14% of national GDP by 2030, enterprise leaders are being pushed to modernise how they operate, deliver services, and leverage data.

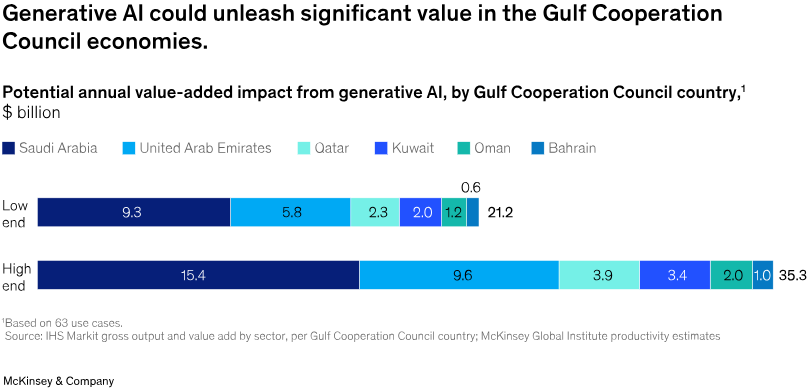

According to McKinsey and IHS Markit, AI has the potential to contribute over $15.4 billion to Saudi Arabia and $9.6 billion to the UAE in productivity gains by sector.

The chart below shows projected AI contributions across GCC countries:

Source- Mckinsey & company and IHS Markit

Beyond national agendas and projected economic impact, enterprise leaders are navigating real internal questions:

- How do we justify AI investments when ROI isn’t immediate?

- Can our current teams handle AI tools without disrupting delivery?

- Are our data systems clean and connected enough to support AI implementation?

Enterprise AI opportunities in the UAE by sector

AI adoption in the UAE isn’t happening in isolation. It’s being actively shaped by sector-level needs, regulatory initiatives, and competitive pressure.

According to the AWS–IDC study, over 88% of AI-investing enterprises in the UAE reported measurable improvements in performance.

Here’s how leading industries are applying AI to gain value:

Energy and materials

AI in UAE enterprises is being applied across predictive maintenance, energy demand forecasting, emissions tracking, and materials supply chain optimization.

From ADNOC’s AI-driven operational intelligence to predictive asset management in utility providers, UAE enterprises are investing in AI to drive both efficiency and sustainability outcomes.

Banking and finance

AI is transforming compliance, fraud detection, and customer service. Use cases include credit risk modelling, document intelligence, and virtual banking agents.

UAE banks are also using AI for real-time transaction monitoring to meet evolving regulatory expectations.

Logistics and supply chain

AI integrations in logistics power route planning, predictive maintenance, and automated inventory management. Leading UAE logistics providers are integrating AI with IoT data to reduce fuel costs and improve last-mile delivery across GCC routes.

Manufacturing and industrial automation

AI is playing a growing role in predictive maintenance, defect detection, energy optimisation, and robotic process automation.

UAE-based manufacturers are adopting AI to reduce downtime, improve production quality, and integrate real-time monitoring across equipment and assembly lines.

As part of national industrial strategies like Operation 300bn, the push for AI-driven manufacturing is accelerating in both public and private sector facilities.

Healthcare

AI applications range from medical imaging analysis to real-time triage and patient flow optimisation.

Providers are using AI to analyse EHRs, predict disease progression, and personalise treatment plans — aligned with the region’s goal of tech-enabled healthcare delivery.

Retail and ecommerce

AI-driven dynamic pricing, personalized recommendations, and customer segmentation tools are improving conversion rates and customer loyalty.

UAE retailers are also using AI in visual search, demand forecasting, and supply planning.

Public sector and government

With the UAE Strategy for AI 2031 and investment in AI talent hubs and smart cities, public agencies are deploying AI in digital ID systems, traffic management, and citizen experience platforms. Government entities are setting the pace in AI policy and early adoption pilots.

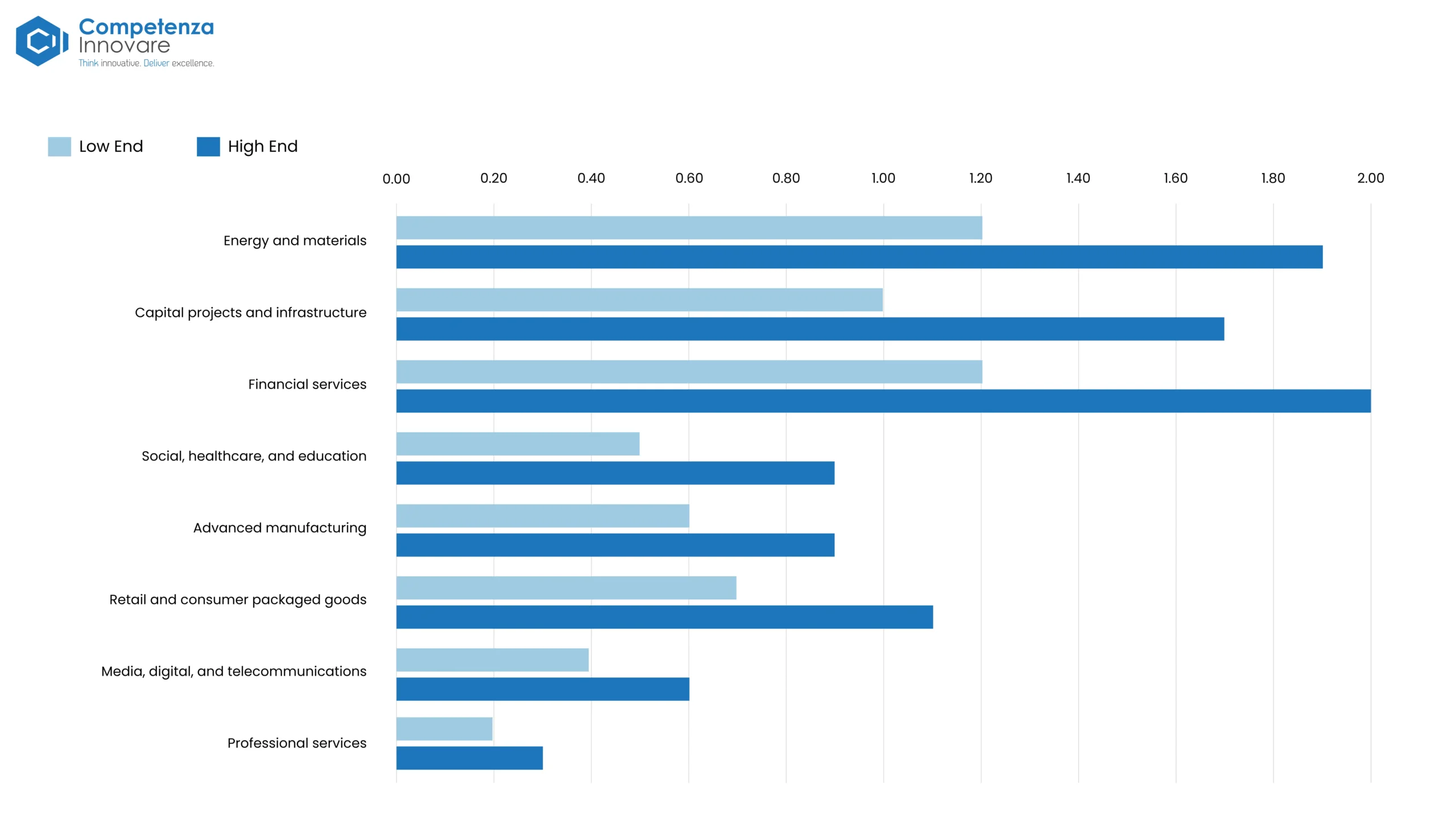

The data chart below shows the potential value added impact from GenAI in the UAE by sector. [$ billion]

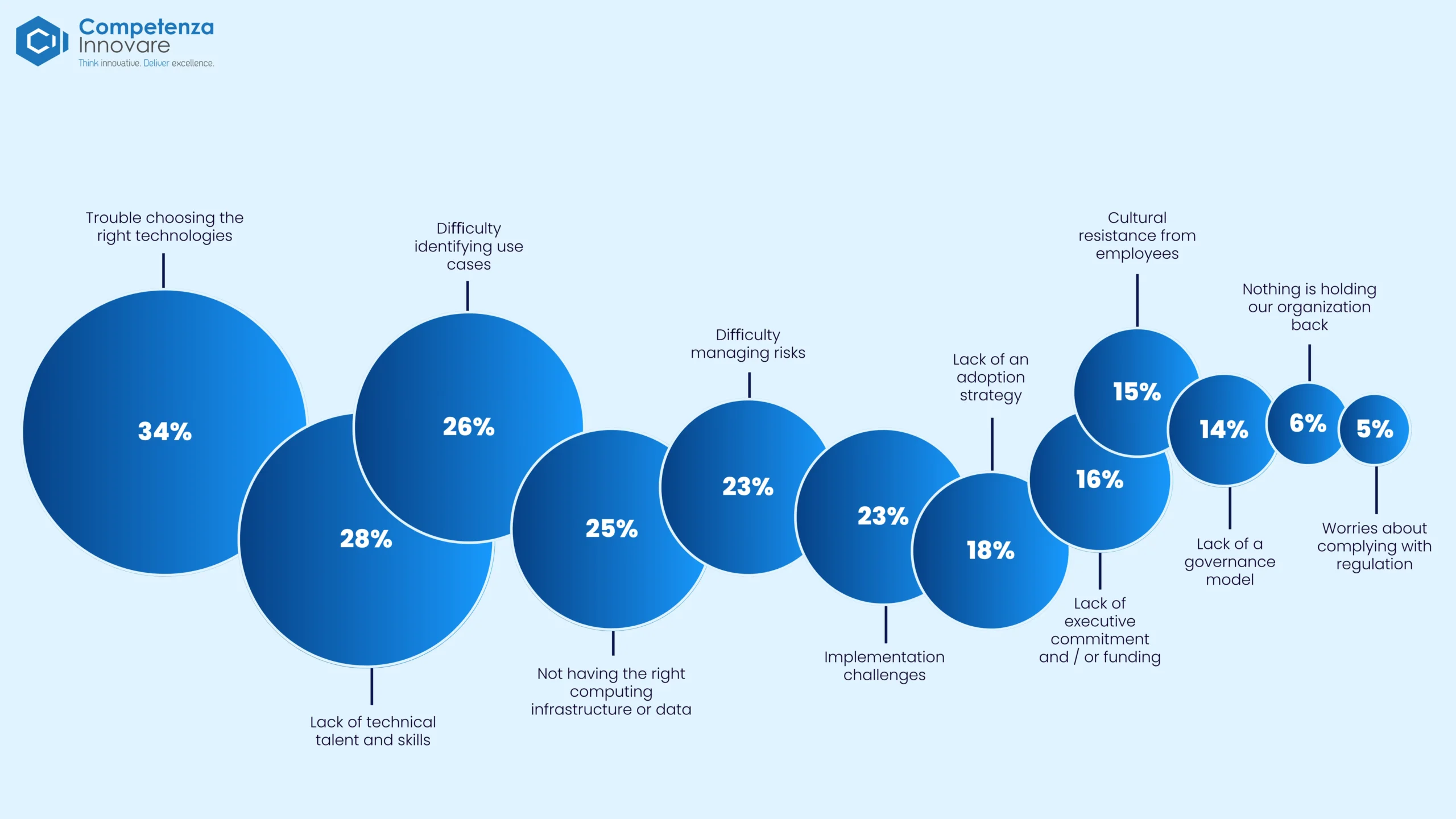

Top challenges in enterprise AI adoption

AI adoption is accelerating across the Middle East, but many enterprises lack the foundations to scale it effectively. Over 80% feel pressured to adopt AI, yet nearly one in three leaders cite gaps in talent and technology readiness.

1. Choosing the right technologies

With hundreds of platforms and tools available, many enterprise leaders struggle to align the right AI solutions with business goals.

The complexity of vendor ecosystems and the lack of clarity on tool capabilities are major blockers to confident investment.

2. Lack of technical talent and AI skills

Technical talent scarcity in the UAE remains a critical issue. Organizations report limited access to AI engineers, ML specialists, and data governance experts, often delaying projects or increasing outsourcing dependency.

3. Unclear use cases and ROI visibility

Many organizations in the region have difficulty identifying high-value, scalable use cases for AI.

While the pressure to adopt AI is high, leaders often lack frameworks to evaluate feasibility or return on investment beyond initial pilot phases.

At this stage, working with experienced domain-focused consulting teams can help clarify the business case, prioritize initiatives, and ensure that investments align with actual operational needs.

4. Infrastructure and data readiness

Outdated systems, poor data quality, and limited cloud integration continue to restrict AI scaling. Foundational investments in governance, data platforms, and interoperability are still catching up.

5. AI risk and implementation concerns

From ethical AI to data misuse, many leaders are hesitant to scale due to regulatory pressure and the lack of formal risk mitigation strategies.

Only a small percentage currently monitor compliance or enforce human validation for generative AI use.

AI tools and technologies used in the UAE

Enterprise AI adoption in the UAE is powered by a growing ecosystem of cloud platforms, model development stacks, and local solution providers:

- Cloud platforms: Tools like Azure AI and AWS MENA services are preferred for scalable, PDPL-compliant deployments.

- Core AI techniques: Enterprises are applying natural language processing (NLP), computer vision, and deep learning to automate tasks and extract insights.

- Local innovation: UAE-based vendors and custom AI labs are building domain-specific models and language capabilities for finance, health, and public services.

How can enterprises prepare for AI adoption and implementation?

While interest in AI is high, most UAE organizations are running pilots without full integration into business strategy.

Here’s what high-performing organisations are doing:

- Align AI with business goals: Start with a clear goal that is related to your business, customer & processes and then add AI.

- Get data foundations in order: Connect siloed systems, enforce compliance, governance, and prioritise data quality over model complexity.

- Invest in talent pipelines: Combine upskilling with partnerships (e.g. MBZUAI) to close AI capability gaps.

- Set up AI governance early: Few regional firms have formal AI oversight — those that do move faster and scale more responsibly

How Competenza enables AI success for UAE enterprises

At Competenza, we help enterprises move from AI experimentation to real-world impact. Whether you’re building a first AI pilot, modernising legacy systems, or scaling custom models, our role is to bridge strategy with delivery.

- We support MVP development for AI-powered products, with discovery workshops, helping validate use cases before full-scale rollout

- Our teams integrate AI into existing enterprise stacks — from ERP and CRM systems to cloud data platforms

- We offer hybrid team models combining regional context with offshore scale — ideal for UAE compliance and multilingual UX

- For organisations lacking in-house AI capabilities, we provide domain-aligned tech consulting, model development, and delivery oversight

Conclusion: Building enterprise value with AI in the UAE

“Despite high interest in AI, organizations need to invest in talent and infrastructure to bridge the gap between enthusiasm and readiness.”

— State of AI in the Middle East, Deloitte & MBZUAI

Beyond automation, organizations are using AI to make better decisions, improve customer experiences, and scale operations efficiently.

For every industry and type of businesses, real value can be harnessed by aligning AI with business priorities, working with trusted data, and building the right structure and team to deliver results.

FAQs

1. What’s driving the increase in enterprise AI investment across the UAE?

A combination of national strategy, industry competition, and early success stories is accelerating investment. 69% of UAE organisations plan to increase AI spend, with a significant share focusing on generative AI use cases in customer service, logistics, and operations.

2. Why do AI projects in UAE enterprises often struggle to scale?

Many AI initiatives in the UAE stall after the pilot phase due to weak alignment with business strategy, lack of internal AI maturity, and difficulty integrating solutions into existing workflows. Research shows, 1 in 3 UAE organisations struggle to define and measure AI impact, making scale difficult without clear KPIs or governance.

3. How are UAE businesses preparing their data for AI use?

Enterprises are investing in data prep, integrating legacy systems, and applying governance models that align with PDPL. AI-readiness starts with high-quality, structured data and accessible data pipelines, not just model selection.

4. What are the top risks UAE enterprises face in AI adoption?

The biggest risks include data security, poor model explainability, and regulatory non-compliance under PDPL. There are also risks tied to over-reliance on external vendors without internal understanding of how AI tools make decisions, especially in regulated industries like finance and healthcare.

5. How are enterprises measuring ROI from AI investments in the UAE?

ROI is often measured in terms of decision accuracy, process efficiency, and speed to market — not just revenue impact. 72% of organisations increased AI investment following strong results, even though many still face difficulty in quantifying it clearly. This shows growing trust in AI’s operational value, even when direct financial attribution is complex.

Dista

Dista